The Russian government has unveiled a bold new policy aimed at supporting its soldiers engaged in the “special military operation” in Ukraine.

Under Federal Law No. 391-FZ, signed on November 23, 2024, participants and their families can have up to ₽10,000,000 (approx. $95,869) in overdue loans forgiven.

At first glance, this seems like a compassionate move to ease the financial burden on military families and bolster morale.

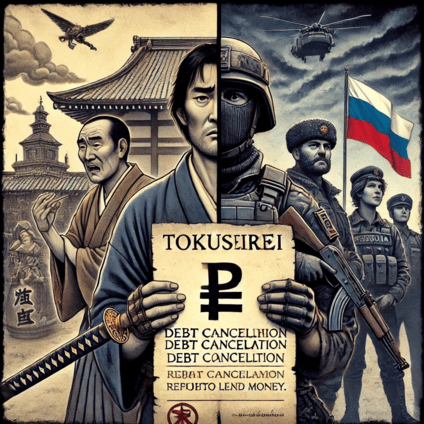

But history offers a cautionary tale: Japan’s tokuseirei (debt cancellation ordinance) from the Kamakura period.

What initially appeared to rescue indebted samurai ultimately contributed to the fall of the Kamakura shogunate.

Could Russia’s debt policy risk similar unintended consequences?

In this article, we’ll explore the details of this modern policy, the lessons of history, and the potential long-term impacts!

- Statement of the Government of Russia

- Debt Forgiveness and the Fall of Kamakura

- Debt Relief: Short-Term Gain, Long-Term Risks

- Russian Netizens React to this Decision

Statement of the Government of Russia

The Russian government has framed this policy as a necessary measure to alleviate financial stress on military personnel and their families.

cited from Pravo.ru

This move is part of a broader strategy to support the military and incentivize participation in the ongoing conflict. By easing financial pressures, the government hopes to boost morale, encourage enlistment, and show its commitment to those serving in the armed forces.

But what exactly does this law entail? Let’s break it down!

Who is Eligible for Debt Cancellation?

- Military Personnel: The law applies to citizens who are mobilized or conscripted into the Russian Armed Forces for military service.

- Volunteers: It also covers those who sign a contract of at least one year starting December 1, 2024, to take part in the special military operation.

- Spouses: The policy extends to the spouses of these military personnel as well.

What Debts Are Affected?

- The debt must arise from a loan agreement where a court ruling for debt collection or an enforcement document has already been issued before December 1, 2024.

- The maximum debt that can be written off is capped at 10 million rubles.

- The debt relief begins as soon as the individual signs their military service contract.

Changes to Deadlines

In addition to the debt forgiveness, the law also extends certain deadlines. Specifically, Article 3 of the law increases the previously specified 30-day period to 180 days, giving more time for certain processes related to the debt cancellation.

Why Is This Important?

This new policy is part of a larger effort to offer financial support to those serving in the Russian military. It serves several purposes:

- Alleviating Financial Strain: By wiping out significant debt, the government hopes to reduce financial stress on soldiers and their families, allowing them to focus on their military duties.

- Encouraging Military Enrollment: The promise of debt forgiveness is likely to incentivize more people to enlist for service, especially with the added financial burden of ongoing conflict.

- Demonstrating Support for the Armed Forces: With this move, the government is signaling its commitment to the welfare of soldiers, offering both practical and financial support during a time of national crisis.

Ultimately, the debt cancellation policy aims to ease the economic burden on military personnel while reinforcing the government’s backing of its forces in the ongoing operation.

Debt Forgiveness and the Fall of Kamakura

Debt forgiveness policies aren’t new. Throughout history, governments have attempted to ease financial burdens during times of crisis, but such measures often come with unintended consequences.

A striking historical parallel can be found in 13th-century Japan, where a similar policy ultimately weakened the ruling government and contributed to its downfall.

In the 13th century, Japan’s Kamakura shogunate faced a dire economic and military crisis.

The Mongol invasions of 1274 and 1281, led by Kublai Khan, strained the shogunate’s resources to the breaking point.

Although Japan ultimately repelled both invasions, thanks in part to the legendary “kamikaze” (divine winds) typhoons, the aftermath left the regime grappling with severe financial challenges.

The gokenin—samurai who served as the shogunate’s backbone—had borne the brunt of the fighting. Unlike wars within Japan, these external invasions offered no opportunity to claim spoils or new lands as compensation.

This lack of material reward left the samurai heavily indebted, as they struggled to maintain their livelihoods and fulfill their military duties.

To address their growing discontent, the shogunate issued tokuseirei (徳政令), debt cancellation ordinance intended to provide financial relief.

At first, this ordinance was welcomed as a lifeline for struggling samurai. However, the policy quickly unraveled:

- Economic Distrust: Merchants and lenders, wary of further losses, ceased extending credit to samurai, fearing their loans could be nullified by future decrees.

- Eroded Authority: The repeated issuance of tokuseirei signaled desperation, diminishing the shogunate’s legitimacy and encouraging opposition.

- Structural Failures: The root causes of samurai debt—such as the rising costs of military service and economic stagnation—remained unaddressed.

As economic and social tensions mounted, the shogunate’s control weakened. By 1333, the Kamakura regime fell, with the erosion of trust among the gokenin playing a significant role in its downfall.

Debt Relief: Short-Term Gain, Long-Term Risks

Russia’s debt forgiveness for soldiers echoes some of the dynamics seen in Kamakura Japan. On the surface, it’s a strategic move to rally support and alleviate personal financial strain.

However, such a policy may carry hidden risks. For one, it could create divisions within society—why should soldiers alone benefit from debt relief, while ordinary citizens facing economic hardships continue to struggle?

Furthermore, the policy could destabilize Russia’s already fragile economy.

Just as the tokuseirei deterred lenders in Kamakura Japan, modern financial institutions may grow wary of extending loans, fearing similar government interventions.

The ripple effects could strain not only the financial system but also public trust in the state’s ability to manage the economy fairly and effectively.

While debt cancellation might provide immediate relief to soldiers and their families, it doesn’t address the underlying challenges—economic stagnation, political instability, and the human toll of prolonged conflict.

History reminds us that policies driven by short-term objectives often come at the expense of long-term stability.

If the Kamakura shogunate’s experience teaches us anything, it’s that eroding trust—whether among citizens, allies, or economic players—can sow the seeds of collapse.

The parallels to Russia today may not be exact, but they are worth considering as the country navigates this critical juncture.

Russian Netizens React to this Decision

The Russian government’s decision to forgive up to ₽10 million in debts for soldiers participating in its “special military operation” has sparked a flood of reactions online.

As of November 24, 2024, the feedback on RIA Novosti’s article reveals that 894 people support (👍) the policy, while 271 oppose (👎) it.

Screenshot of a news article from RIA Novosti, titled

“Путин подписал закон о списании долгов по кредитам участников СВО,” dated November 23, 2024

This shows a clear majority in favor, signaling widespread approval of the government’s financial relief initiative aimed at soldiers and their families.

Supporters of the policy are likely viewing it as a much-needed acknowledgment of the sacrifices military personnel are making, and as a way to ease their financial burdens during a time of national crisis.

However, the fact that nearly 30% of respondents oppose the measure highlights concerns about its fairness.

Critics question why only military personnel are receiving such relief, while ordinary citizens who are also struggling with financial difficulties are left without similar support.

This policy may offer immediate assistance, but its sustainability remains in question. As it continues to unfold, it raises a deeper question:

Can modern policymakers learn from past mistakes, or are we witnessing the early signs of a risky, long-term gamble?

Only time will tell.